Gambling Winnings Self Employment Tax

Second, it allows you to deduct expenses incurred while gambling such as food, travel, and equipment. However, professional gamblers must pay self-employment tax which is considerable - recreational gamblers do not pay this tax. Deciding on whether you should file as a professional is a very complex decision that is full of risks and uncertainties.

Gambling Winnings Self Employment Tax 2019

Can't Access the Ignition Casino

Customers were waking up Monday morning to learn they can no longer access the popular Ignition Casino and online poker room online.

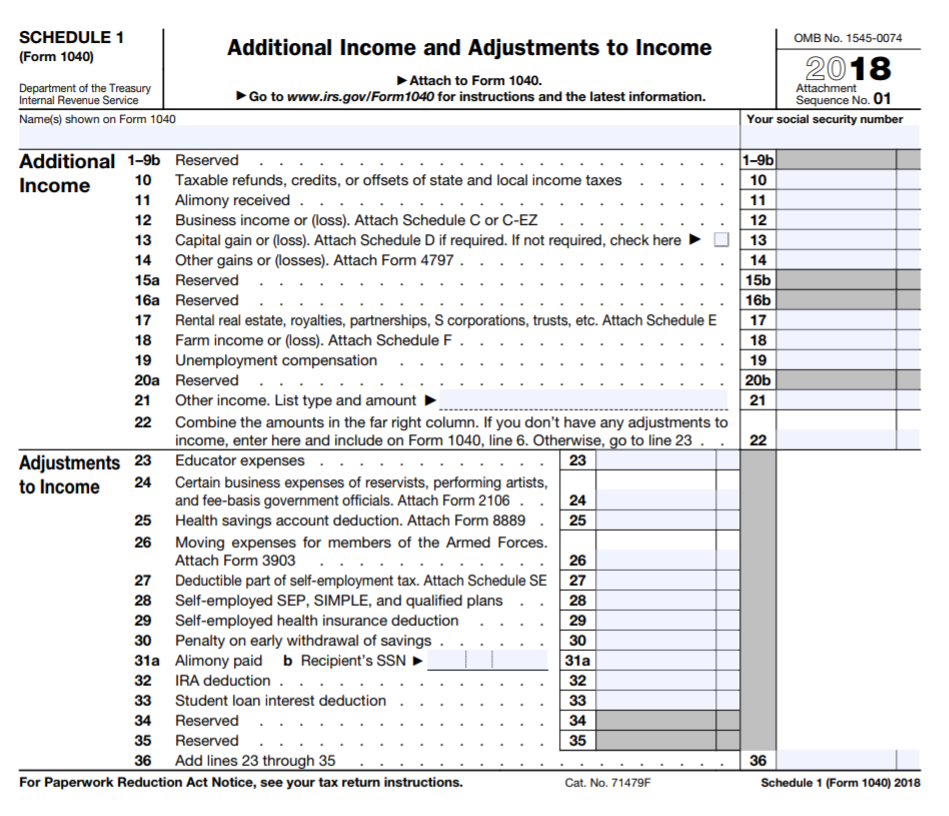

- Rather than claiming your winnings as “other income” on your Form 1040, you can file Schedule C as a self-employed individual. This is an important distinction, because you can deduct your other costs of doing business on Schedule C, ultimately reducing your taxable income.

- Jul 30, 2019 Winnings from gambling can be taxable and should be reported on your tax return. Winnings may be reported on a W2-G. However, if you itemize deductions on the schedule A, then you may deduct gambling losses only up to the amount of the winnings claimed on your tax return.

Can't Access XBet! WTF?

Federal Tax Gambling Winnings

Customers were waking up Monday morning to learn they can no longer access the popular XBet.com website.

Gambling and Sports Betting News January 13, 2020: BetBlocker First Corporate Donation

Here are today's headlines in the world of gambling and sports betting as they happen - Monday January 13, 2020.

Can I Bet on the Fanduel Sportsbook App From South Carolina?

You will not be able to bet using the FanDuel sportsbook app from South Carolina, however, websites such as Jazz Sports are accessible and do take bets from those in South Carolina. Open your anonymous betting account with just a valid email. Up to $1000 cash signup bonus.

Can I Bet on Bovada From South Carolina?

Bovada can be accessed from the state of South Carolina as can plenty of Gambling911.com-endorsed online gambling websites.